Firehouse #5 in Lawrence, Kansas

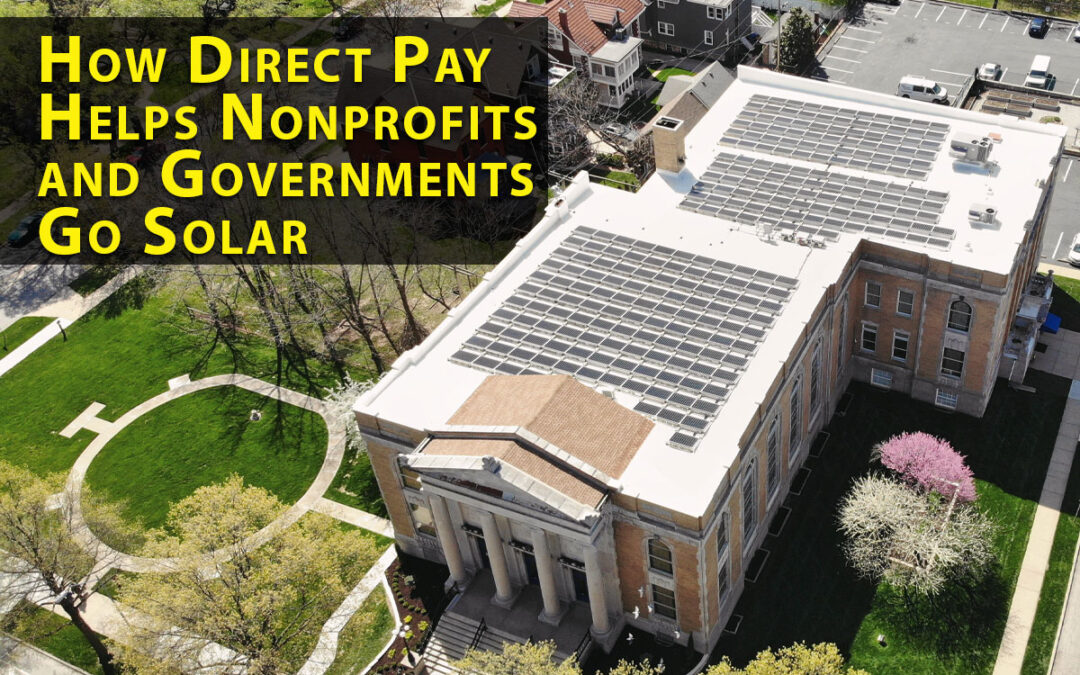

Direct pay allows these organizations to take advantage of clean energy tax credits, making it easier and more affordable to invest in improvements like solar power, energy storage, EV charging stations and purchasing electric vehicles. Now governments, nonprofits, tribes, publicly owned utilities and churches have access to the full value of clean energy tax credits just like individuals and businesses. Tax-exempt entities can now claim the equivalent amount of tax credit in the form of direct payment from the IRS.

With most solar projects, individuals and businesses receive a 30% tax credit towards the cost of the design, materials and installation. With direct pay, tax-exempt entities now have access to those same financial incentives.

First Baptist Church of Overland Park, Kansas

The direct pay provision simplifies the process of claiming clean energy tax credits. Before the Inflation Reduction Act, tax-exempt entities had to endure a complex claims process that discouraged some organizations from investing in clean energy. Direct pay eliminates this process, making it easier and more affordable for these entities to claim the credits.

The Direct Pay Process

Eligible organizations need to complete the following steps to claim direct pay for the clean energy projects:

- Identify and confirm that the clean energy project in question qualifies under the Inflation Reduction Act.

- Complete the project, place it into service and determine the corresponding tax year.

- Determine when your organization’s tax return will be due.

- Complete pre-filing registration with the IRS before your organization’s tax return is due.

- Once your organization receives a valid registration number, file the tax return by the due date, including extensions.

- Receive your direct payment from the federal government.

While the IRS has published a full list of rules and resources on its website to help you through the process, our solar consultants can also assist you with working through the process of applying your clean energy project for direct pay.

SEE IF YOUR HOME OR BUSINESS IS A GOOD MATCH FOR SOLAR

GET A FREE QUOTE

Favorite Solar in 2023

Our mission at Good Energy Solutions is to provide our customers with honest, real solutions to reduce their fossil fuel consumption and lower their long term energy costs. Our combination of hands-on experience, education, and outstanding customer service make our company the clear choice to help you achieve your energy goals.

Our mission at Good Energy Solutions is to provide our customers with honest, real solutions to reduce their fossil fuel consumption and lower their long term energy costs. Our combination of hands-on experience, education, and outstanding customer service make our company the clear choice to help you achieve your energy goals.

Founded in 2007 by Kevin and Shana Good, Good Energy Solutions has earned a reputation for our expert reliable service, long workmanship warranties, and quality commercial and residential solar installations.

We are engineers and craftsmen designing for efficiency while keeping aesthetics and longevity in mind. Because of our installation quality and customer service, Good Energy Solutions' solar panel systems feature some of the longest product and service warranties in Kansas and Missouri. Also, we have more NABCEP® Certified Solar Professionals on staff than any other company in Kansas or Missouri. To achieve this certification, PV installers must demonstrate that they possess extensive solar PV installation experience, have received advanced training, and passed the rigorous NABCEP certification exam.

If you would like to know more about solar power for your home or business, contact us here.